Real estate law

Notaries Claudia Carl and Dr. Patrick Hollmann have many years of experience in the notarial counselling of real estate transactions in a wide variety of options. We will support you with something as simple as a “classic” purchase or the sale of a single-family home. We work with all real estate law, including condominiums and complex notarial project developments and portfolio purchase agreements.

Field of work

We will assist you in all notarial matters, including:

- Purchase contracts for undeveloped or developed land and freehold flats

- Portfolio purchase contracts

- Developer contracts

- Declarations of partition and community regulations

- Transfer of real estate property ownership

Frequently asked questions about real estate purchase contracts

1. What happens before and during the notarisation date (real estate purchase agreement)?

Before the notarisation date, we inspect the land register where you’ll be sent a draft contract. If any questions should arise, you can discuss them with our notary clerks or with the notary at any time before the notarisation or, ask these questions as part of the notarisation. Property purchase contracts are complicated legal contracts. Your contract is a set of rules individually adapted to your situation with all the necessary securities. The notary ensures that legal risks are avoided where possible. During notarisation, the entire text of the purchase agreement will be read and explained to you by the notary. The complete reading aloud of the document is a legal requirement. As a rule, the notary will correct any spelling mistakes by hand during this process and can also make changes to the content at the request of the parties involved during the recording date. It is therefore not necessary for any typographical errors or data to have been completely corrected in the draft before the certification date.

2. What do I need to bring to the certification meeting?

Please bring a valid personal identification card or passport with you for certification. If you are a non-EU citizen or a citizen of a country that is part of the European Economic Area (in addition to EU countries such as Iceland, Lichtenstein or Norway), please present a valid passport before certification. According to the Anti-Money Laundering Act, we are required to identify the parties involved in the certification. Please provide us with your so-called tax identification number or (if you are a legal entity, trading company, freelancer or sole proprietorship) your “economic identification number” together with your place of business. We are obliged to forward this information to the Real Estate Acquisition Tax Office.

3. What is included in the sale?

- All things firmly attached to the land plot or building (the buildings standing on the land plot, central heating system, fitted kitchen units, awnings, floor coverings, sanitary facilities, carport/prefabricated garages, stoves, blinds, prefabricated wooden houses if they rest on the foundation) are always sold together with the land plot.

- “Accessories” shall also be deemed to be sold (unless individual accessories are expressly excluded in the sales contract). Examples of accessories: sauna, existing oil reserves for heating, loosely attached parabolic antennas.

- Other movable objects are not sold, unless expressly stated otherwise in the contract of sale. In case of doubt, garden furniture and tools, sandboxes and swings, lamps and furniture are not included in the sale.

- If it is stated in the purchase contract that a certain amount of the purchase price is attributable to accessories or movable objects, then this amount is generally not subject to real estate transfer tax. In this case, real estate transfer tax can be saved on this separately reported amount. If you would like such a detailed list for reasons of tax savings, please send us a list by e-mail in good time before the notarisation date. This email should state which accessories/mobile items are to be listed separately (e.g. “garden tools, residual fuel oil in the tank, kitchen furniture”) and which part of the purchase price is to be allocated to these items in total. If these items do not account for more than 5 – 10 % of the purchase price, the chance of recognition by the tax office increases. Please note that the list may not contain any “items” that are firmly attached to the building (see above).

- Without prior consultation with your financing bank, you should not state a separate purchase price for movable items in the purchase contract. This is often not accepted by the financing bank. It is best to clarify with your tax advisor whether tax recognition promises success in a specific case before certification. The notary will not provide any tax advice.

4. How and when do I have to pay the sales price? Is the acquisition of ownership secured with payment?

After it has been ensured that you will actually acquire ownership of the property (without any encumbrances entered in the land register such as land charges, etc.), will we send you a so-called purchase price maturity notification. Upon receipt of this written notification, you may transfer the purchase price to the account(s) of the seller specified therein and/or to banks still registered in the land register. You must not and should not transfer the purchase price before you have received this notice of maturity. How much time you can allow yourself with the payment of the purchase price after you have received our due date notification depends on the purchase contract.

5. How is the exemption from burdens carried out?

As a rule, you want to acquire the property unencumbered in Sections II and III of the land register. Another regulation can be found, however, if encumbrances (usually in Section II of the land register) have to be taken over because they cannot be deleted (e.g. rights of way for a “back-up property” or old encumbrances with outdated contents which are decades old and were supposed to guarantee the uniformity of the buildings in the past. Such old encumbrances can often be found in the districts of Frohnau, Zehlendorf and Dahlem in Berlin, for example, since these areas were formerly established as residential areas or garden cities). After notarisation, the notary writes to the “seller” bank, which is still registered with a land charge/mortgage, and asks for the necessary cancellation permits to be sent. If the mortgages to be cancelled still secure residual credit amounts of the seller, the bank will only send the cancellation approvals under the escrow condition that they will only be used after payment of the residual amount in the sum of a total to be quantified. After notarisation, the notary writes to the “seller” -Bank, which is still registered with a land charge/mortgage, and asks for the necessary cancellation permits to be sent to his or her hands. If the mortgages to be cancelled still secure residual credit amounts of the seller, the bank will only send the cancellation approvals under the escrow condition that they will only be used after payment of the residual amount in the amount of an amount to be quantified.

6. How does the financing of the purchase price by the financing bank work?

In order to enable the buyer to pay the purchase price, it is usually stipulated directly in the purchase agreement that the seller agrees to an early loan of the object for the purpose of granting a land charge to the financing bank and grants the buyer power of attorney in the purchase agreement. This is the tried and tested procedure in practice and does not involve increased risks for any party to the contract due to the appropriate notarial drafting of the contract. The bank will hand over a land charge order form to the buyer, which the buyer should please forward to us. At the same time, the buyer can then agree a further notarisation date for the notarised appointment of the land charge with our notary clerks.

7. Is the seller liable for material defects?

As a rule, the seller is not liable for material defects of the property, and assumes no warranty for the condition of the property or the “old” buildings on it. This is in line with normal contractual practice and does not constitute an improper disadvantage for the buyer. Something else applies as far as the parties expressly agree on a certain quality of the object of purchase or the seller gives corresponding guarantees, or if the seller knows of a considerable defect and fraudulently conceals it. In these cases, the seller is always liable for the material defect that has occurred.

8. Transfer of ownership, benefits, burdens and risks.

Usually, the obligation to bear costs and burdens (e.g. housing benefit, property tax and insurance premiums for residential building insurance) and traffic safety (e.g. clearing and gritting obligation) are transferred to the buyer upon full payment of the purchase price (or deposit in a notary’s escrow account). Conversely, the keys for the contractual object are to be handed over to the buyer from this point in time and the buyer is now entitled to any rental income in relation to the seller. The buyer is thus already the “felt owner” when the purchase price has been paid in full (or when the purchase price has been deposited in a notary’s escrow account). As a rule, formal ownership is not transferred to the buyer until a few months later, when it is recorded in the land register. As soon as the buyer has been entered in the land register as the owner, we will automatically inform the buyer.

The building insurance and the real estate tax office will contact the seller after full payment of the purchase price, during handover because of premiums and when real estate taxes are due to be paid, since the seller is still formally the owner until the registration of the buyer as owner in the land register. For the periods from handover to complete payment of the purchase price, the seller is entitled to a corresponding claim for reimbursement of costs from the buyer.

9. Who bears the contract costs?

The contract costs are usually borne by the buyer.

As a rule, the seller only bears the notary and court costs incurred for any charges to be cancelled (e.g. land charges, mortgages) as well as any bank processing fees.

If a seller or buyer does not appear in person at the notarisation date, but instead has a representative appear for him, the party not personally present at the notarisation date usually bears the additional costs incurred as a result (triggered by a notarial subsequent approval of the purchase contract which becomes necessary later).

10. Which costs arise and in what amount?

The amount of the costs of the land registry office (for new entries and deletions in the land register, which take place within the framework of the execution of a purchase contract) and of the notary are uniformly determined throughout Germany in the GNotKG ( Law on Costs of Voluntary Jurisdiction for Courts and Notaries) and are legally mandatory and non-negotiable. The amount of the land transfer tax depends on the federal state in which the property is located (e.g. Berlin 6.0 % of the purchase price). The higher the purchase price, the lower the percentage costs for land registry and notary public. Depending on the amount of the purchase price, the total costs of the notary and the land registry office together (very rough “rule of thumb”) range between approx. 0.9 – 1.4 % of the purchase price (without ordering the land charge and without settlement via the notary’s escrow account).

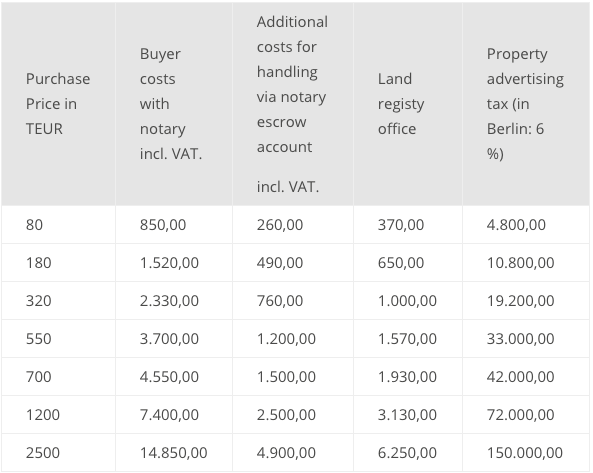

The following table gives you a rough overview (the details are not binding for your concrete purchase contract) of the costs rising with increasing purchase price amount, all details are given in euros:

The stated values are not binding, but may be significantly higher or lower in your specific case, especially as the notary’s fees may depend not only on the purchase price amount, but also on other parameters. For reasons of transparency, the table gives only a very rough indication using approximate totals. However, you are welcome to have us calculate the costs incurred in your case.

If the buyer (partially) finances the purchase price and a land charge order is necessary for the financing bank, additional costs (not included in the table) are incurred by both the notary and the land registry office, which together amount to approximately 0.5 – 0.8 % of the nominal amount of the land charge (“very rough rule of thumb”).

11. What happens to the seller's building insurance?

The seller or purchaser must notify the building insurer of the sale without delay. With a formal transfer of ownership to the buyer, the building insurance (protection against fire damage, etc.) is automatically transferred by law from the seller to you (cf. §§ 95 ff. VVG). You are entitled to terminate the insurance relationship with immediate effect or (at your request) for the end of the current insurance period after the transfer of ownership has taken place.

12. Is processing via a notary escrow account safer than direct payment to the seller?

The acquisition of the property in accordance with the contract is equally secured for the buyer, irrespective of whether the purchase contract initially provides for payment to a notary escrow account or instead provides for a so-called direct payment to the seller. Only in a few cases is payment to a notary escrow account necessary or permissible under the Notarisation Act because of the existence of a legitimate security interest.

A case in which the processing via a notarial escrow account can be permissible and very sensible is, for example, the case in which the buyer wants to move into the property very quickly. Without a notary’s escrow account, a transfer of ownership to the buyer will often not take place until 6-12 weeks after the notarisation date and the exact date of the change of benefit, burden and transfer of ownership cannot usually be foreseen without a notary’s escrow account.

13. What happens after the notarial certification date?

In addition to the pure notarisation activity, the notary is also responsible for a large number of other activities in connection with the execution of a purchase contract. For example, the notary is obliged to inform the tax office and the expert committee about the purchase. They supervise the proper and correct entry in the land register of priority notice, land charge and transfer of ownership. They ensure that all certificates and approvals as well as negative certificates required for processing are obtained and (not required if a notary’s escrow account is used) arrange for notification of the due date of the purchase price to both parties to the contract, assuming full liability. Furthermore, they shall ensure that the transfer of ownership does not take place before the full purchase price has been paid to the seller.

14. Tips

The contents of this leaflet are based on a standard sales contract without any special features. In individual cases, the processing may take considerably longer under certain circumstances. This may be the case, for example, if the seller has inherited the property and is not yet in possession of an official certificate of inheritance. Then the transfer of ownership, benefits and encumbrances can be delayed by further weeks, or even months. In such cases, it may make sense for the buyer under certain circumstances to provide for the establishment of a notary’s escrow account in the sales contract, as this can guarantee an early transfer of ownership, benefits and encumbrances despite a possibly lengthy process.

We strive to process your purchase contract as quickly as possible. However, please understand that our employees have a large number of different processes to carry out. We therefore ask you to quote the file number and certificate number if possible when making enquiries. To note: You will automatically receive all necessary information and documents from us. In urgent cases, please contact the notarial secretary indicated on the correspondence by telephone. These are the experienced clerks for your transaction and can provide you with information on the status of the transaction as quickly as possible. Of course, the notary is also personally available to answer any questions you may have.

15. Timeline after notarisation of the purchase contract

(Please note that these are rough time estimates, which may differ case by base)

Start: Notarial purchase contract certification

1 week after certification

Dispatch of the purchase contract and notice of conveyance:

Buyers and sellers receive a certified copy of their purchase contract a few days after the notarial certification date. We apply to the land registry office for the entry of a priority notice of conveyance in the land register for the buyer. With the entry of the priority notice in the land register (public register), it is clear to everyone that the buyer has acquired a “right” to the acquisition of ownership of the property. The priority notice of conveyance blocks the land register for entries to the detriment of the buyer which he himself has not (co-)initiated.

2 weeks after certification

Land charges:

If the buyer (partially) finances the purchase price through a loan, then he can arrange a notary appointment at any time after the notarisation of the purchase contract in order to have the notarial land charge order carried out for the granting of the loan. For this purpose, the buyer must submit the corresponding land charge order form of his financing bank to the notary at least one working day in advance. In the ideal case, the buyer sends us the land charge order form in good time before notarisation of the purchase contract, because then the notarial land charge order can be carried out immediately after the purchase contract notarisation without requiring a separate date.

4 – 9 weeks after certification

Land transfer tax assessment:

As a rule, the buyer receives a real estate transfer tax notification from the responsible tax office within 4-9 weeks of the notarised purchase agreement becoming effective. He should pay the real estate transfer tax promptly in his own interest, as the tax clearance certificate required for the transfer of ownership will only be issued afterwards.

4 – 10 weeks after certification

Issuing of the purchase price maturity notification:

It is only after the notary can guarantee the buyer that he will actually receive the property in accordance with the contract in the event of payment of the purchase price, that the notary sends the so-called purchase price due notice to the buyer (and a copy to the seller). The notary cannot guarantee a contractual transfer of ownership until the registration of a priority notice of conveyance has been secured at the agreed level and all the documents required for the contractual transfer of ownership are available to him/her (e.g. the cancellation permits for all encumbrances still entered in the land register and not to be assumed by the buyer; in the case of the sale of an apartment, the consent of the administrator of the condominium owners’ association, if required; in the case of the property purchase agreement, the municipality’s negative clearance, according to which it will not make use of its statutory right of first refusal, etc.).

As soon as the buyer has received the notary’s written notification of the purchase price due date, he can pay the purchase price at any time without risk. The latest date for payment is stated in the purchase contract. The notary expressly points out to the buyer in the written purchase price due date notification that the buyer does not have to pay the entire purchase price to the seller, but rather a part of the purchase price to the “seller bank”, still entered in the land register and the rest to the account specified by the seller. All details (including the relevant account details) for the Buyer shall result from the written notification of the purchase price due date.

6-12 weeks after certification

Transition of encumbrances and benefits:

Once the purchase price has been paid in full, the buyer becomes the “perceived owner”, since possession, use, encumbrances as well as road safety obligations are transferred to them from this point in time, unless otherwise agreed in the purchase contract.

Application for transfer of ownership in the land register:

After the seller has confirmed the complete receipt of purchase price, we submit the application for transfer of ownership to the buyer at the land registry.

5 – 12 months after certification

Transfer of ownership:

The buyer is registered in the land register (public register) as a new landowner. The seller and buyer receive a written notification of registration from the notary public. With the transfer of ownership, the building insurance is transferred to the buyer. The seller or buyer must inform the building insurance company in writing of the transfer of ownership immediately after it has happened. The buyer has the right to cancel the building insurance within one month after the transfer of ownership has taken place, either with immediate effect or at the end of the current insurance period.

Notification at the basic control unit:

The buyer is obliged to report the change of ownership to the tax office (real estate tax office) within three months after the transfer of ownership has taken place.

Any further questions?

berlin@cht-legal.com

Phone Number

+49 (0)30 2000589-0

Address

CHT Rechtsanwälte GbR

Potsdamer Straße 58

10785 Berlin

© 2023 CHT Rechtsanwälte GbR | Home | Privacy Policy | Imprint | Contact | Career