Notarial Real Estate Purchase Model Contract with explanations

At the end of the document, you can download it as a PDF file to download

CHT Rechtsanwälte GbR – Potsdamer Straße 58 – 10785 Berlin

Part I. Model Real Estate Purchase Contract

In the case of the sale of condominium ownership or part ownership („Wohnungseigentum“, „Teileigentum“), our explanations in Part II. (Supplementary information on real estate purchase contracts for condominium or part ownership) apply in addition to this model purchase contract (Part I.).

Before me, the signing notary public

Dr Patrick Hollmann

with the official seat in Berlin,

Potsdamer Straße 58, 10785 Berlin,

- Mr…

– the appeared person 1. hereinafter also referred to as „Vendor“ or “Seller” -,

- Mrs …

– the appeared person 2. hereinafter also referred to as „Buyer“ / “Purchaser“-,

and that the contracting parties were each acting for their own account.

The persons appearing – acting as stated above – requested the notarisation of a

Purchase Agreement

of the following content:

(1) The Seller is the owner of the property entered in the land register of the local court of

Folio

registered property:

The plot is developed with a single-family house.

The aforementioned property shall hereinafter be referred to only as the „Property“ or “object of purchase”.

(2) The land register is encumbered as follows:

§ 2 Sale

and included in the purchase price stated in § 3 are those movable objects which are listed in Annex 1 attached to this contract of sale, the notary read out Annex 1, those present referred to it and approved it.

The parties agree that ownership of these objects passes to the buyer upon payment of the purchase price owed.

(1) The purchase price amounts to

as soon as the following conditions have been met:

has been registered, with a rank not lower than the encumbrances mentioned in § 1 (2) as well as any other encumbrances in the creation of which the Buyer has participated.

Their use may only be dependent on payment requirements which are covered by purchase price.

The notary and the Buyer shall not be obligated do verify whether the requested redemtion claims are correct. The remaining amount of the purchase price is to be transferred to the following account specified by the Seller:

Account holder:

IBAN: ………………………………………………………………………………………..

(1) The Buyer submits to the Seller’s immediate enforcement of this deed on account of the obligation to pay the purchase price plus default interest in accordance with section 288 (1) of the German Civil Code (Bürgerliches Gesetzbuch – BGB) from the date of issue of the enforceable copy. If applicable: The Seller submits to immediate compulsory execution from this deed due to his obligation to vacate and procure possession of the object of purchase..

(2) Upon application, an enforceable copy may be issued to the respective entitled person without further proof.

(3) Several parties who are obliged to make the same payment owe and are liable – also within the scope of the submission to enforcement – as joint and several debtors.

§ 5 Handover, development costs

shall pass to the Buyer from the calendar day following the crediting of the purchase price (also if weekend / public holiday), if applicable: at the earliest, however, from …on (hereinafter “transferdate”).

and cleared of objects not sold with it.

insofar as such measures have been carried out to date or the Seller has received a cost notice for such contributions before the transfer date; otherwise these shall be borne by the Buyer.

§ 6 Defects in title and quality

The Seller guarantees though, that he is not aware of any such easements or obligations as well as of any unfulfilled official requirements. The Buyer does not take over any encumbrances currently registered in the land register, with the exception of the encumbrances registered in Section II, no. ……….. The parties approve of, and apply fort he deletion of all encumbrances in the land register, including any future encumbrances which are not taken over by the Buyer.

Descriptions of the Property in brokerage exposés do not constitute advertising by the seller and are not deemed to be agreed or owed and do not constitute a material defect.

(1) The Seller hereby approves of the entry in the land register of a priority notice (subject to a resolutary condition) for the benefit oft he Buyer in the specified acquisition relationship. The resolutary condition is the receipt by the land registry of a deed from the notary in which the notary declares the occurrence of the resolutary condition.

pursuant to section (1) sentence 2 if the parties instruct the notary to do so in text form or if the Seller declares to him in writing that he has withdrawn due to non-payment of the purchase price and the Buyer does not prove to the notary within four weeks upon written request that the purchase price has been paid in full. If the Buyer proves to the notary that a part of the purchase price has been paid, the notary may only declare the occurrence of the resolutory condition concurrently against reimbursement of the amount already paid. The notary is not obliged to initiate the cancellation if the Buyer presents reasons according to which the reserved claim has not expired.

The parties agree on the transfer of ownership in the specified acquisition relationship. However, they at this time do not approve and apply for the registration of the change of ownership in the land register. Rather, they irrevocably authorise the notary for this purpose and beyond their deaths and instruct him to initiate the transfer in accordance with this power of attorney by personal deed only when he has received proof of the purchase price credit and conclusive evidence of a non-cash purchase price payment within the meaning of § 16a GwG.

The power of attorney is unlimited in relation to third parties.

Implementing authorisation

(1) The Seller is obligated to cooperate in the mortgaging of the Property even before the transfer of ownership. He therefore authorises the Buyer to encumber the Property in the rank prior to the priority notice in favour of the Buyer with liens and in-rem declarations of submission to enforcement proceedings (also pursuant to § 800 of the Civil Procedure Code – ZPO) in unlimited sums in favour of lenders subject to German financial services supervision as well as to make all declarations and approvals required for registration and submission to execution in rem, also with regard to rank, and also to make corresponding declarations of security/collateral purpose. The above powers of attorney shall only apply if the following agreed provisions are reproduced at least in essence in the document establishing the lien:

The notary shall notify the lien creditor of the above restriction of the security/collateral purpose agreement and send him a copy of the purchase agreement.

(2) The parties irrevocably authorise the notary’s employees (without creating any personal liability to them) Mrs … and Mrs … : to make and receive all declarations (also declarations of conveyance) necessary or useful for the execution of this purchase agreement, including all declarations of rank, in particular to approve and apply for land register entries and deletions of all kinds. The authorised representatives are also authorised to make additions or amendments to this contract; internally, this must be agreed in advance between the authorised representatives and the parties.

of the issuing parties and with the right to grant sub-authorisations. They may only be exercised before the officiating notary, his representative or another notary of his firm, in particular Mrs. Notary Claudia Carl.

(4) The parties commission and authorise the notary to represent them without restriction in the land register proceedings and to obtain and receive (also in accordance with section 875 (2) of the Civil Code – BGB) the declarations, approvals and encumbrance release documents required for the effectiveness or for the execution of this deed as well as to make and withdraw all applications and declarations, also in part, which are expedient for the execution of this deed in the land register.

The Buyer shall bear the real estate transfer tax as well as the costs of the notarisation and its execution, however, the Seller shall bear the additional costs arising due to the cancellation of encumbrances not taken over (above all, any trustee and execution fees of the notary triggered thereby, cancellation costs of the land registry). The costs of any required confirmation of power of attorney or declaration of approval shall be borne by the respective represented party itself.

§ 11 Notes

The notary also explained in particular:

as well as the liability of the respective owner for any outstanding public charges;

§ 12 Final provisions

According to the Seller’s assurance, there are no surface waters on the object of purchase and there are no fishing rights that could be (co-)sold; the notary informed that a declaration of waiver of pre-emption rights according to state fishing laws therefore did not have to be obtained here.

4) The parties agree to e-mail communication by the notary within the scope of the execution of the contract together with the sending of the copy of the purchase contract in digital form.

_______________________________________

(The above transaction together with any handwritten amendments by the notary to the original, were read out to the persons appearing by the notary, approved by the persons appearing and signed by their own hands and by the notary as follows: …

Part II.

(Supplementary information on real estate purchase contracts for condominium or part ownership)

If condominium ownership is to be sold, then our explanations in this Part II. apply in addition to Part I. For the sake of simplicity, we will speak overall only of „condominium ownership“ („Wohnungseigentum“) or „condominium“, the same rules also apply to

Our notarial model contract of purchase for the sale of condominiums differs essentially only in §§ 1, 4 and 5 from the model purchase contract fort the sale of a single-family house (Part I.). These deviating §§ 1, 4 and 5 are printed below and (only in the places deviating from Part I.) provided with supplementary explanations. Therefore, also in the case of the sale of condominiums, first/additionally read our explanations on the model purchase contract for the sale of a single-family house in Part I., namely also on §§ 1, 4 and 5 there.

Excerpts from our notarial

Model contract of purchase for the sale of condominium ownership (§§ 1, 4 u. 5):

§ 1 Current situation

(1) The Seller is the owner of the residential property entered in the land register of the local court … of

registered …../10,000th of a co-ownership share

(„Miteigentumsanteil“)

on the property

Serial. No. 1 -plot …, land parcel …, size: … sqm,

Building and open space

…

if applicable:

The aforementioned co-ownership share together with all rights associated therewith shall hereinafter only be referred to as the “object of purchase” or „Property“.

(2) The land register is encumbered as follows:

Section II: …

Section III: …

The notary has inspected the electronic land register at …………… and discussed the entries. (currently being viewed before notarisation)

The administrator (shall receive a copy of the purchase contract from the notary) is currently the company: … , address: ….

According to the parties, the object of purchase does not include any real estate registered on another land register Folio that may also be sold (e.g. shares in private roads, parking spaces, etc.).

§§ 2-3 (see Part I.: Model purchase contract fort the sale of a single-family house)

§ 4 Submission to enforcement proceedings

If applicable: The Seller submits to immediate compulsory execution from this deed due to his obligation to vacate and procure possession of the object of purchase.

(2) Upon application, enforceable copies may be issued to the respective beneficiary without further proof.

(3) Several parties who are obliged to perform the same service owe and are liable – also within the scope of the submission to enforcement – as joint and several debtors.

§ 5 Handover, development costs

(1) Possession, benefits, risks, charges and duties of care and liability for the Property shall pass to the Buyer on the calendar day following the crediting of the purchase price (also if weekend / public holiday) (hereinafter referred to as “transfer date”). The Property shall be handed over to the Buyer free of any actual use and rights of use of the Seller or third parties and cleared of objects not sold with it. The Seller shall be obliged to maintain proper management until then. The Seller assures that there is no right of first refusal of a tenant (§ 577 BGB) because the object of purchase is not rented.

The Seller warrants that no payment to the community of owners and the administrator will be open fort he period up until the transfer date.

After preparation of the annual housing allowance statement by the administrator for the financial year of the transfer date, the Seller and the Buyer shall be obliged to settle any subsequent payments / refunds relating to this financial year among themselves proportionately in accordance with the ratio of their periods of possession in the corresponding financial year if they cannot be clearly allocated. However, insofar as consumption costs are determined by measurement and allocated accordingly, they shall be borne by the Seller until the transfer date, thereafter by the buyer.

Where appropriate: (the inclusion of such a regulation is, however, not helpful anymore(redundant) since 16.09.2020):

(3) The Seller shall bear development contributions and other resident contributions for building workinsofar as such measures have been carried out to date or the Seller has received a cost notice for such contributions before the transfer date; otherwise these shall be borne by the Buyer.

§§ 6-12 (see Part I.: Model purchase contract fort the sale of a single-family house)

© Dr. Patrick Hollmann. The work including all its parts is protected by copyright. Any use outside the narrow limits of copyright law without the consent of the author is prohibited and punishable. This applies in particular to duplications, translations, microfilming and storage and processing in electronic systems.

Download the model contract

In-depth knowledge

(2) Formation of the purchase contract via so-called direct payment or via notary’s escrow account?

According to the law (§ 57 BeurkG), the notary is now generally no longer permitted to set up a notary escrow account. This applies even in the case of an emphatically consensual wish of the contracting parties. Courts rule that the notary must “reject” the parties’ wish.

In particular, the mere existence of the following circumstances does not, as a rule, permit the establishment of a notary escrow account: The mere residence of a party abroad; the necessity to discharge many different land charges of the seller; the desire of the parties for a notary escrow account out of convenience or out of the mistaken belief that a notary escrow account is “safer”.

The main application of a recognised legitimate interest for setting up a notary escrow account is the buyer’s wish to move into the property himself within a very short time (e.g. two weeks after notarisation). Experience shows that a direct payment (secured for the buyer) would not be possible within such a short time (e.g. the land registry office will not enter a so-called priority notice in the land register protecting the buyerso quickly; see explanation [19]. However, a seller is not willing to hand over the property before payment of the purchase price and thus without setting up a notary’s escrow account it would not be possible for the buyer to move into the property quickly. The notary’s escrow account can help here if the seller is ready to hand over the property after merely depositing (“interim parking”) the purchase price in a notary’s escrow account. However, the seller does not receive the purchase price any earlier than he would receive it from the buyer himself in the case of a direct payment.

Why is a notary escrow account generally not safer than a direct payment?

The use of a notary’s escrow account means that the buyer transfers the purchase price to a trust account (notary’s escrow account, account holder is the notary) at the time agreed in the purchase contract. The later payment from the notary’s escrow account to the seller or to the seller’s banks, if applicable, is then arranged by the notary. However, this only takes place after the so-called pay-out/payment prerequisites have occurred. These (payment) preconditions are identical to those that must always be waited for in the case of a so-called direct payment by the buyer before transferring the purchase price to the seller. In both cases (payment from the notary’s escrow account by the notary or direct payment by the buyer to the seller) it is equally the notary (and not the buyer) who assumes the responsibility for a secured payment. Finally, in the case of the so-called direct payment, the buyer only initiates a transfer of the purchase price when the notary has first responsibly checked the occurrence of all (payment) preconditions and has certified this to the buyer in writing by means of the so-called notarial due date notification („notarielle Fälligkeitsmitteilung“) in accordance with § 3 (2) (explanation [22]). Since, therefore, the “giving away” of the purchase price to the seller – with or without a notary’s escrow account – depends on the same preconditions and the same time must be waited for this and since – with or without a notary’s escrow account – it is the notary (and not the buyer) who is responsible/liable for checking/certifying the occurrence of these preconditions:

A notary’s escrow account is regularly no more secure than a direct payment, but only leads to a generally unnecessary “interim parking” of the purchase price in a notary’s account and additional notary’s costs (custody fees) as well as bank charges and possibly negative interest on the part of the bank. The notary’s escrow account can only offer “more” security in certain exceptional cases, e.g. if a compulsory auction of the property to be sold has already been scheduled or if the sale is carried out by an executor of a will, etc.

Why does the seller receive the purchase price just as late as in the case of a direct payment, even when using a notary’s escrow account?

Earlier pay-outs/payments to the seller (without waiting for the occurrence of the payment prerequisites) – be it by the notary when using a notary’s escrow account or be it by the buyer himself in case of a so-called direct payment – would be a high risk for the buyer (so-called unsecured advance payment („ungesicherte Vorleistung“). The enforceability of an acquisition of ownership of the property by the buyer (with the agreed freedom from encumbrances in the land register) would then not yet be guaranteed with the transfer of the purchase price.

What are the disadvantages of a direct payment?

The disadvantage of direct payment for the buyer may be a certain “inconvenience” that he may have to transfer different parts of the purchase price to different accounts (to be shared by the notary), – whereas with a notary’s escrow account he can be content with a single transfer of the entire purchase price to the notary’s escrow account. Also, in the case of a direct payment, the earliest possible transfer date of the property cannot be predicted with legal certainty. In the case of a so-called direct payment, the transfer of the property to the buyer always takes place after the purchase price has been credited to the seller (and not already with the “interim parking” of the money on a notary’s escrow account). However, how quickly the notary can make the purchase price due for (secure) payment to the seller (i.e. how quickly the payment prerequisites occur) is primarily not within the notary’s sphere of influence and can only be roughly and non-bindingly “estimated” in individual cases on the basis of empirical values (explanation [22]).

(3) How can a contracting party who is not present at the notarisation be represented?

Option 1: Representation on the basis of an existing notarial power of attorney deed

If a certified/notarised power of attorney exists, please send us a copy in advance, e.g. by e-mail, so that we can check whether it is sufficient. It is then mandatory to bring the original (if the notary/public authority has only certified („unterschriftsbeglaubigt“) the signature of the principal – “certifiedpower of attorney” – „unterschriftsbeglaubigte Vollmacht“) or a so-called authorised notarial “copy” (in the meaning of the german word „Ausfertigung“, not only in the meaning of „beglaubigte Kopie“) (if the notary hasread the power of attorney document to the principal, i.e. it has been “protocolled” – “protocolled power of attorney“) to the notarisation appointment.

The authorised notarial copy (in the german meaning of „Ausfertigung“) of a notarised power of attorney is only suitable if it bears a so-called execution note specifically addressed to the desired representative: “This copy is issued to Mr. …., signature and seal of the notary of the power of attorney document”.

Possibility 2: representation without power of attorney

If there is no sufficient notarial power of attorney, it is possible to have another person act on one’s behalf without a power of attorney („vollmachtlose Vertretung“). After notarisation of the purchase contract, the party represented without power of attorney must additionally approve the purchase contract before a notary public in order to make the purchase contract effective. We send the draft for such a post-approval after the purchase contract has been notarisedand the represented party then goes with this draft to any notary and signs the approval before him. This notary sends us back the declaration of approval certified by his signature and thus the contract of sale is now effectively post-approved. The represented party does not have to be able to speak German for the post-approval, because it is a mere “signature certification”. If the subsequent approval is only possible abroad, we will inform you on request how to proceed. As long as we have not received the subsequent approval, the purchase contract is (pending) invalid.

A similar procedure must be carried out if the representative represents the represented party at notarisation on the basis of an alleged verbally granted power of attorney („mündlich versicherte Vollmacht“). In this case, however, the representative is liable to the contracting party for the fact that the power of attorney was actually granted orally. In this case, not the validity of the contract, but only its execution in the land register, depends on the subsequent submission of the power of attorney confirmation/re-approval certified by a notary.

Particularities, if exceptionally a so-called consumer contract („Verbrauchervertrag“) should exist(these particularities then apply to all types of representation):If a natural person (consumer, § 13 BGB) wants to be represented by someone else and if on the other side of the purchase contract a GmbH (Limited liability company), GmbH & Co. KG, KG, OHG or similar (entrepreneur, § 14 BGB) is opposed to the consumer on the other side of the purchase contract, then this is referred to as a so-called consumer contract; in such a case, the consumer may at most be represented by so-called genuine persons of trust (relatives, close friends, lawyer, tax advisor; not: estate agents, the other party to the purchase contract, notary’s clerks etc.). Most of the parties involved are aware of the further special complication of so-called consumer contracts: For the protection of the consumer, notarisations may then only take place after the consumer has received the draft of the purchase contract from the notary more than 2 weeks ago (2-week “waiting period”, § 17 Paragraph 2a BeurkG).

(4) Tax identification number („steuerliche Identifikationsnummer“)/ business identification number(„Wirtschaftsidentifikationsnummer“)

The identification number of companies is called a “business identification number”. If such a number has not yet been assigned to your company by the tax office, we require your written declaration to this effect (so-called negative declaration).

If you do not have a German tax identification number, please inform us of your foreign tax identification number and write to us truthfully by e-mail that you do not have a German tax identification number. A German tax ID is only not issued to those who (i) neither have their actual residence (ii) nor their habitual residence (iii) nor are registered in Germany with their main residence/sole residence according to the population register (iv) nor are liable to pay tax in Germany in any way.

(4a) What is the procedure if a party is not proficient in German?

Notary himself translates into English

If the party involved is sufficiently proficient in English, we can prepare or execute the notarisation in two languages, German and English, if desired. The notary will then translate the deed himself orally at the notarisation meeting. To assist the notary with the translation, we prepare a non-binding (not completely accurate) translation into English in advance, which we send to you in advance for your guidance. Such an assignment will incur additional notarial costs as stipulated by law, which are higher the higher the purchase price. Please feel free to ask us about these if required.

The party involved organises an interpreter

Alternatively, the party not sufficiently proficient in German can organise and commission an interpreter himself/herselfand at his/her own expense and bring him/her to the notarisation meeting. The notary’s office itself does not organise and commission interpreters. The interpreter must be a state-certified interpreter who must translate the entire text (word by word) of the deed orally during the notarisation. It is not relevant whether the interpreter additionally prepares a written translation text for the party involved.

(6) So-called consumer contract („Verbrauchervertrag“)

If an entrepreneur (e.g. as a buyer) faces a consumer (e.g. as a seller), then a so-called consumer contract („Verbrauchervertrag“) exists and then

– notarisation may only take place if the consumer has received the draft contract directly from the notary’s office more than 2 weeks ago (so-called waiting period, § 17 (2a) BeurkG);

– the consumer must be personally present at the notarisation or may at most be represented by genuinely trusted persons (relatives, good friends, lawyers, tax advisors; but not: estate agents, notary clerks, etc.) (§ 17 Para. 2a BeurkG);

– the contents of the purchase contract are, according to the law (§ 310 BGB), generally considered to be general terms and conditions of business („allgemeine Geschäftsbedingungen“) provided by the entrepreneur and are thus subject to the supplementary effectiveness barriers of §§ 307-309 BGB to the detriment of the entrepreneur.

(8) Type of use (§ 1)

The type of use indicated in the land register (e.g. building and open space, garden land, recreational area, arable land) is often not kept up to date and is therefore often of no significance. It is not uncommon, for example, for building land to be listed in the land register as garden land or arable land. In this respect, it is not the entry in the land register but rather the development plan or the information provided by the building authority that is decisive for the question of whether land can be built on.

“Traffic area” means that the plot of land has been dedicated in whole/part to the public as a traffic area (e.g. road, pavement) (i.e. the state has the right of access to this area similar to an owner and is responsible for it); it is quite normal that, for example, in the case of a building plot, a partial area is dedicated as a traffic area (this is usually a public area located outside the fenced plot of land, such as a pavement, etc.).

(10) Encumbrances in Section II of the land register (§ 1 (2))

Many encumbrances entered in Section II of the land register are encumbrances that are to be taken over by a buyer, i.e. they are not deleted (e.g. rights of way that allow the owner of a property in the rear to cross the purchase property or easements for energy supply companies that allow them to lay supply lines). Sometimes there are entries in Section II that are more than 100 years old, which are often outdated in terms of content, but nevertheless cannot be deleted and must be taken over by the buyer.

However, certain other encumbrances registered in section II are usually to be deleted by the seller in the course of the execution of the purchase contract (e.g. registered residential rights, usufructuary rights or priority notices).

In § 6 (1) – legal and material defects – all possible encumbrances in section II or III of the land register are explicitly listed, which are to be taken over by a buyer; all encumbrances not mentioned there are to be brought to cancellation by the seller – with the help of the notary.

(11) Encumbrances in Section III of the land register (§ 1 (2))

Why are the seller’s mortgages still registered at the time of sale?

In most cases, when a property is sold, mortgages are still registered in section III if the seller had taken out a loan himself to finance his purchase at the time. Banks have financing loans secured by such mortgages. The land register does not show the current amount of the seller’s loan, because only the original loan amount is registered – even if the loan has been almost completely repaid in the meantime.

How is it ensured that the buyer does not take over these mortgages of the seller, i.e. that they are deleted?

Encumbrances in section III of the land register are regularly not taken over by the buyer, but deleted within the scope of the execution of the purchase contract. The notary takes care of this (§ 3 (3)) by requesting the seller’s bank to send the necessary deletion authorisation to his attention after notarisation of the purchase contract. The bank registered in section III (so-called land charge creditor – „Grundschuldgläubigerin“) then sends the deletion authorisation to the notary with notification of the concrete payment amount (redemption amount – „Ablösebetrag“) which it can still claim from the seller for the purpose of settling the loan. This redemption amount is usually made up of the seller’s outstanding loan debt plus a so-called early repayment fee („Vorfälligkeitsentschädigung“) to be borne by the seller. The bank then allows the notary to submit its deletion authorisation to the land registry for deletion, but only as soon as it has received from the buyer its so-called redemption amount from the purchase price to the account named by it.

Within the scope of his notification to the buyer of the occurrence of the purchase price due date conditions (cf. § 3 (2)) – so-called notarial due date notification („notarielle Fälligkeitsmitteilung“) – the notary also informs the buyer of which part of the purchase price (redemption amount) the buyer must pay to the seller’s bank (together with account details) and which part of the purchase price he must pay to the seller himself.

The seller’s still existing loan is thus repaid by the buyer from parts of the purchase price (according to precise instructions from the notary, who informs the buyer of the account data and amounts). In this way, the buyer can be sure that the notary can have the lien on the property that is still registered deleted from the land register after payment of the purchase price. The notary may only make the purchase price due for payment to the buyer if the amount of the agreed purchase price is sufficient to fully offset the redemption amount notified by the seller’s bank. In order to ensure the execution of the purchase agreement also for the buyer, the buyer and the notary may consider the redemption amount notified by the seller’s bank as binding and fixed. It is up to and at the risk of the seller to subsequently assert claims against his bank, if necessary, if the redemption amount demanded by his bank appears to him to be too high.

The seller is legally responsible to the buyer for ensuring that his bank forwards the deletion documents to the notary public within a reasonable period of time after the notary public has requested them.

(12) Acquisition by several purchasers in fractions („Bruchteile“) (§ 2)

The co-ownership share (fractions) in the property purchased by each of you as purchasers (usually in the case of two purchasers – e.g. married couples – each purchases ½ of the co-ownership share in the property) constitutes an independent property in the land register. Each of you can therefore sell or encumber his or her co-ownership share to a third party in the future, even against the will of the other. You also have no mutual rights of first refusal to it. According to the law, each of them (after their death also each of their heirs) may at any time and without cause demand the dissolution of their co-ownership community in the property by way of a so-called partition auction („Teilungsversteigerung“), which results in the entire property being auctioned off.

In practice, however, buyers usually leave it at these legal regulations, whether for reasons of cost or ignorance of the legal situation. However, if you wish to change this legal situation, there is a possibility to do so. For this purpose, at your request, a mutual right of first refusal can be stipulated in the notarial purchase contract and it can also be stipulated that the partition auction of the entire property, which is otherwise possible at any time without reason, is permanently excluded. Then the partition auction can only be demanded for so-called important reasons, e.g. if the other purchaser becomes insolvent or third party foreclosure measures take place with regard to the co-ownership shares. Please inform us in advance of the notarisation if you would like such provisions to be included in the purchase contract.

The appointment of the right of first refusal together with the agreed exclusion of the possibility of a partition auction at any time increase the business value of the deed (and thus the notarial fees) by approx. 60 % (with two purchasers) compared to the pure sale. The land register fees then increase by at least approx. 2/3.

(13) Co-sale of movable property (§ 2)

What is the advantage or disadvantage of expressly stating in the purchase contract the co-sale of movable objects and further stating which part of the purchase price is attributable to these co-sold movable objects named in the purchase contract?

Advantage: The tax office does not charge real estate transfer tax on this partial amount of the total purchase price; the buyer can therefore possibly save money in this way. Please note that the value of the movable property sold with the property must then be stated in the purchase contract by all parties for the purpose of forwarding it to the tax office. In your own interest (avoiding involvement in tax fraud!), only state realistic market values that take into account the age and condition of the items.

Example: In the purchase contract it is agreed that of the total purchase price (€ 500,000.00) € 20,000.00 are allotted to the sold refrigerator, the leather sofa and the Sony television. Then the buyer saves the payment of the real estate transfer tax on these € 20,000.00, i.e. € 1,200.00 for a property located in Berlin (the real estate transfer tax in Berlin is – as of 01.01.2022 – 6%) or € 1,300.00 for a property located in Brandenburg (the real estate transfer tax in Brandenburg is – as of 01.01.2022 – 6.5%).

Disadvantage: Movable property does not usually constitute valuable collateral (security) for banks, so this can worsen the so-called mortgage lending value of the purchase property (with the consequence of less favourable loan conditions or rejection of the financing). Without prior consultation with the financing bank, the buyer should not agree on the co-sale of movable property or at least not indicate a separate purchase price for movable property in the purchase contract.

Am I allowed to conceal from the notary that certain movable objects (which are not automatically considered to be included in the sale anyway, see above) are to be included in the sale? Can’t the seller and buyer simply conclude a contract of sale for movable property themselves without a notary – in private writing – in addition to the notarial real estate purchase contract?

You must avoid this at all costs in your own interest. This applies at least to the extent that you and the other party are already in agreement when the purchase contract is notarised as to what else is to be sold and at what purchase price and if, in addition, the conclusion of the real estate purchase contract is dependent on the co-sale of the movable objects from the point of view of at least one party. Otherwise, such non-notarised ancillary agreements lead to the ineffectiveness of the real estate purchase contract! This can also mean the participation of all parties in a criminal loan fraud of the financing bank of the buyer, as the bank is thereby deceived about the mortgage lending value or more favourable loan conditions are thereby obtained.

(17) Tax depreciation of the purchase price as so-called acquisition costs (§ 3 (1))

As the buyer, do I still have to/should I divide the purchase price in the purchase contract into a part that goes to the building and another part that goes to the land/property share?

As a rule, it is not necessary to break down the purchase price into the land and building portions in the purchase contract. As a rule, this may make sense in individual cases due to tax depreciation options (AfA – so-called depreciation for wear and tear in accordance with Section 7 (4) – (5a) EstG), at most in the case of the purchase of rented property or in special constellations (e.g. purchase of a listed property with the possibility of claiming so-called monument depreciation for tax purposes). The notary does not provide tax advice.

In the case of real estate purchases by private individuals for their own use, there is usually no possibility of claiming the acquisition costs of a property for tax purposes via the so-called AfA depreciation. An exception may be, for example, the purchase of a listed property (special depreciation). When buying rented real estate, on the other hand, the buyer can generally deduct the acquisition costs (but only insofar as they do not apply to the purchased property/property share, but only to the building/flat) – spread over a very long period of time. When buying a condominium, a share in the land of the property is always purchased at the same time.

Depreciation does not fail because no breakdown of the purchase price into the land and building portion is made in the purchase contract. This is because the tax office will then always automatically carry out a breakdown itself, in accordance with an Excel tool published by the Federal Ministry of Finance (see the website of the Federal Ministry ofFinance – „Bundesfinanzministerium“). Only if you are afraid that the tax office might otherwise carry out the breakdown to your disadvantage (i.e. the purchase price share attributable to the land – which is not depreciable – is set too high), you can, as a precaution, have the purchase contract state which share of the purchase price is to be allocated to the land and which share of the purchase price is to be allocated to the building/apartment. The notary does not carry out this breakdown for you, but you (buyer) can inform the notary of the breakdown you want with concrete amounts (if necessary after consulting your tax advisor). If we are informed of a breakdown, we regularly include that the seller is not liable to the buyer for the tax recognition/correctness of this breakdown. However, the tax office will only accept those breakdowns made by them in the purchase contract which are not obviously incorrect (i.e. about which there is “no appreciable doubt”, BFH ruling of 10.10.2000 – BStBl. 2001 II p. 183). The apportionment must be based on the market values for buildings/flats on the one hand and land on the other.

(19) Even in order to accelerate the execution of the purchase contract it is no wise decision not to wait for he entry oft he priority notice in the land register before payment, (§ 3 (2))

A buyer is strongly advised to wait for the actual registration of the priority notice in the land register before paying any part of the purchase price (this is provided for in our model purchase agreement). Only in exceptional cases may a notarial purchase agreement instead allow the mere “securing” or “guaranteeing” of the entry in the land register for the entry of the purchase price due date to be sufficient in order to allow the purchase price due date requirements to occur more quickly. This is because a mere “securing” of the registration would not protect the buyer to the same extent as a registration – due to possible impediments to registration that are not recognisable. For example, protection would then fail in the event of the seller’s prior opening of insolvency proceedings, which would become known to the land registry even before the registration of the priority notice of title actually takes place, or in the event of preceding other applications for registration at the land registry, which are inadvertently not properly registered there. As a precautionary measure, a buyer should also clarify in advance with his financing bank whether the latter has any objections to the payingout a loan even if the priority notice of conveyance is merely “secured”.

(20) Documents required for effectiveness and execution, § 3 (2).

In the normal case of a land purchase contract, no “approvals” are required after notarisation, but only the declarations to be obtained by the notary from the competent state authorities that they are not exercising a statutory pre-emptive right or that they are not entitled to such a right (“negative certificate“). The cases in which the state is entitled to a pre-emptive right and exercises such a right are fortunately very rare. The notary is not responsible for checking whether such a pre-emptive right is relevant in the specific case at all; rather, he must always – for every land purchase contract – request and wait for the negative certificate. To be more precise, even several negative certificates have to be obtained, as there are different pre-emption rights at federal or state level. For the extremely rare case of the exercise of a state right of first refusal, notarial purchase contracts provide a right of withdrawal for the seller, because in this case, which is not his fault, he cannot transfer the property to the state and to the buyer at the same time (cf. § 12 (1)). The rescission then has the consequence that only the purchase contract with the state remains in force. In the case of the sale of condominiums, such negative certificates are generally not to be obtained in the absence of the existence of state pre-emption rights.

Depending on the specific individual case, in addition to the negative certificate, “approvals” may also have to be obtained from the notary as a prerequisite for the due date, e.g. if the property is located in a redevelopment area – „Sanierungsgebiet“ (approval under redevelopment law) or if a contracting party was represented by a representative without power of representation at the time of notarisation (approval of the represented party) or in the case of the sale of condominium property (if it is noted in the land register that transfer of ownerships require the consent of the administrator), cf. part II. § 1 or explanation [63].

The “tax clearance certificate” („steuerliche Unbedenklichkeitsbescheinigung“), on the other hand, is not a prerequisite for the due date of the purchase price (but only for the transfer of ownership to the buyer after payment of the purchase price). This is a certificate issued by the tax office to the notary that the buyer has paid the real estate transfer tax for the purchase to the tax office. The tax office itself sends this certificate to the notary as soon as the real estate transfer tax has been paid. The tax office is informed by the notary about the conclusion of the purchase contract after notarisation and then sends the buyer (usually within 2-12 weeks after the purchase contract becomes effective) the land transfer tax notice with a one-month payment deadline.

(22) How long does it take until the notary can certify that the purchase price is due, i.e. the “traffic light for safe payment is green”? (§ 3 (3))

In the case of the purchase of real estate located in Berlin, this usually takes approx. 5-10 weeks from the notarisation of the purchase contract or from the receipt of the approvals by the notary in the case of notarisation of contracting parties represented without power of attorney. If the property is located in another federal state, this period may be shorter or longer, depending on the federal state/land register district. In some land register districts 3-4 months processing time is still “normal”. The Potsdam and Leipzig land registry offices usually have long processing times. Various special features of your specific purchase contract or the land register situation can also lead to longer periods of time (e.g. in the case of pre-emptive rights noted in the land register). If the notary gives you dates or time periods, these are always non-binding estimates based on his experience. The notary applies to the competent authorities to take the necessary steps. It is not up to the notary when the competent authorities (e.g. the seller’s bank or the land registry or the municipality or, in the case of condominium sales, the property administrator) will comply with his request. The notary can also remind the competent authorities in writing at most after certain time intervals, but he is not responsible for enforcement in the event of refusal/delay. For example, it is the legal responsibility of the seller vis-à-vis a buyer that his bank promptly provides the notary with the necessary deletion authorisations for the deletion of mortgages at the latter’s request or that (in the case of condominium sales) the condominium administrator promptly provides the notary with any necessary administrator approval and proof of his administrator status. Only the seller himself has the possibility to exert legal influence against his bank/the administrator. Calls by notaries’ offices, for example to land registry offices/public authorities within these regular execution times, are regularly pointless.

(24) Rights of the seller in case of non-payment of the purchase price, § 3 (3)

In the event of default in payment of the purchase price, the seller shall be entitled to the following rights in particular (in addition to the possibility of collecting the purchase price by way of compulsory enforcement pursuant to § 4 (1) – see explanation [27] -) in accordance with the statutory provisions (the following explanations only serve as a rough overview and do not make an examination of the specific individual case by the seller “in the case of the cases” unnecessary):

Compensation for the damage caused by delay

The buyer has to compensate the seller for all damage caused by the delayed payment (e.g. interest damage due to the now delayed repayment of a seller’s loan from the purchase price), but at least interest on arrears in the legally regulated amount (among private individuals: 5% interest p.a. above the respective changing so-called base interest rate – the current base interest rate can be found on the website of the Deutsche Bundesbank), §§ 286 para. 1, 288 para. 1, § 247 BGB.

Withdrawal from the purchase contract, so-called major damages

Instead of enforcing the collection of the purchase price with the help of the bailiff, a seller may also decide (in accordance with the statutory provisions, i.e. usually mainly after setting a reasonable grace period in advance) to withdraw from the purchase contract (§ 323 BGB) and/or to claim so-called major damages (cf. §§ 280, 281 BGB). This can lead to the buyer having to compensate the seller for all damages suffered, including lost profit. As a rule, the notary is not competent to receive declarations of withdrawal, so that you must deliver them directly to the other party to the contract.

Who will help me if the other party to the contract behaves in breach of contract? Can I turn to the notary for help?

As an official, the notary is obliged by law to be strictly impartial and neutral. In this sense, he must also execute the notarised contract. Of course, we take this obligation seriously. This includes, among other things, that the notary is not allowed to give information/advice to either the seller or the buyer after the notarisation on what to do now or what legal possibilities exist if the other party does not properly fulfil its obligations. The same applies to questions as to whether the other party is in default or how a certain clause in the purchase contract is to be interpreted/understood, as the seller and buyer interpret the clause differently.

The strict legal requirement of neutrality is occasionally met with incomprehension by some parties – due to ignorance of the strict legal requirements (“The notary must know best, after all he drafted the contract” or “I just want to know what rights I have now” etc.). If the parties are in dispute or one party does not fulfil its obligations, then the parties must settle this among themselves or, if necessary, each party must/may hire its own lawyer to represent its interests. According to the law, this lawyer may not be someone who is employed in our office (the office of the notarising notary).

In the event of a breach of contract by the other party – if no amicable solution can be reached with the other party – it is better for each party to mandate a lawyer in order to avoid costly “formal errors”.

(27) How does enforcement work with the help of the enforcement clause in the purchase contract? (§ 4)

Normally (i.e. without a notarial submission to enforcement), you can only initiate enforcement measures against another person after you have successfully sued them in court and obtained a judgement. This can take months/years and be costly. Only the court judgment obtained in this way is then an “enforcement title”, i.e. the prerequisite for being able to pursue actual enforcement – e.g. seizure of accounts, imposition of state fines, imprisonment, etc. (with the help of the bailiff).

The notarial enforcement clause contained in the purchase contract saves the seller the time and trouble of legal proceedings. The notarial purchase contract itself is – similar to a court judgement – a suitable “enforcement title”.

If the purchase price is not received by the seller on time, the seller can demand that the notary issue an “enforceable copy” („vollstreckbare Ausfertigung“) of the purchase contract. The seller can then – as from a court payment judgment – initiate all compulsory enforcement proceedings permitted by law. For this purpose, however, the seller will then usually turn to a lawyer who will support him in initiating these measures (since the notary is subject to strict neutrality according to the law, our law firm may not advise or support you in this case, for more detailed knowledge see explanation [24]). For example, your lawyer can then have the buyer’s accounts seized via a state bailiff.

In addition to the purchase price, interest on arrears that have accrued since the issuance of the enforceable copy of the purchase agreement shall be enforceable in the amount specified in § 288 para. 1 BGB (5% interest p.a. above the respective so-called base interest rate). The respective valid base interest rate (§ 247 BGB) is published on the website of the Deutsche Bundesbank.

If the seller has submitted to foreclosure because of the handing over of the property, then the buyer can have the seller removed from the property with the help of the bailiff.

However, the implementation of enforcement measures takes time, so that enforcement success is rarely likely to occur sooner than after 2-3 months.

What if a contracting party wrongfully initiates enforcement?

Wrongfully initiated foreclosures from sales contracts occur only very rarely in practice. However, if, for example, the seller were to initiate an attachment of an account even though the full purchase price has been paid, the buyer could stop this enforcement immediately by filing a so-called enforcement counterclaim together with an urgent application. The seller would then be liable for damages to the buyer and would also have to bear the costs of the action.

(28) With possession (§ 5), legal ownership (§ 8) does not yet pass to the buyer at the same time. What does this mean? (§ 5 (1))

The acquisition of possession (actual control of the property, holding the house keys in the hands) and ownership do not take place at the same time. Ownership does not pass to the buyer until approx. 2-12 weeks after payment of the purchase price and acquisition of possession. The reason for the temporal discrepancy is that the parties themselves can take possession immediately after payment of the purchase price, whereas the legal ownership is only legally effected with the transfer of ownership in the name of the buyer in the land register by the employee of the land registry office (Rechtspfleger). Although the notary also submits the corresponding transfer application to the land registry immediately upon payment of the purchase price (more precisely: upon confirmation of receipt of the purchase price by the seller and after it has been proven tot he notary that the purchase price has not fully/partially been paid in cash, cf. § 8), the processing times of the land registry lead to a temporal discrepancy between the acquisition of possession and ownership.

However, the seller and the buyer pretend to each other (with regard to all rights and obligations) through § 5 (1) sentence 1 that the buyer had already become the legal owner on the day of transfer. Therefore, a buyer already “feels” like an owner with the acquisition of possession and regularly does not notice any changes due to his later acquisition of ownership (entry in the land register). Only third parties not involved in the purchase contract (e.g. public authorities, tax office – land tax office -, insurance companies) are not interested in this internal agreement between seller and buyer, they always only contact the person who is (still) registered as owner in the land register, i.e. the legal owner, for all matters concerning the property. Also, the buyer is only in a position to transfer the property to a third party once legal ownership has been transferred to him in the land register (but he can enter into the obligation to do so in a purchase contract beforehand).

Example 1: On 1 November, possession, road safety obligations, etc. have been transferred to the buyer. On 15 November, a pedestrian breaks his leg on the icy pavement in front of the property because no one has gritted the pavement. On 01 December, the buyer is registered as the legal owner in the land register.

The pedestrian can claim damages from the seller because it is always the owner, who is still registered in the land register, who is responsible for traffic safety in relation to third parties. The internal agreements between seller and buyer do not have an effect to the detriment of the pedestrian. However, since the seller and the buyer, according to the contract of sale, place themselves in such a way as if the buyer had already been the legal owner on the date of transfer of possession (1.11.) and thus on the day of damage (15.11.), the buyer must reimburse the seller for the payment.

Example2: The buyer does not pay a homeowners insurance premium due after the transfer of possession (although he is obliged to do so according to § 5 (1)). However, the insurance company will continue to send reminders (for paying the premium) to the seller as long as he is still registered as owner in the land register. The seller must then forward the reminder to the buyer and ask him to settle.

(35) Development and other resident contributions

The municipality may allocate costs for the construction and renewal (not for maintenance) of roads, paths, parking areas and other public facilities as well as costs for connections of the property to the public supply network (gas, water, electricity, sewerage) to the owners of the adjacent properties on a pro rata basis. This only covers connections up to the boundary of the private property, i.e. not up to the house itself. Even in the case of fully developed plots of land, such contributions may be incurred through the construction of additional facilities such as additional street lighting or footpaths/cycleways or through improvements to the road, etc. The municipality may charge such costs at least in part and in full. The municipality may pass on such costs at least partially and proportionately to the owners of the adjoining properties.

After construction, it sometimes takes years until the municipality sends the corresponding cost notices to the adjacent owners. However, since the municipality always demands the costs from the person who is the owner at the time the cost notice is issued, an internal cost allocation regulation between the seller and the buyer is required in the purchase contract. If the purchase contract did not contain a provision to this effect, the seller would be fully responsible for the costs in relation to the buyer according to § 436 BGB (German Civil Code), as long as only the “first cut of the spade” of such remodelling measures had taken place by the date of notarisation (even if the construction measures were not completed until years later). In most cases, our regulation in the purchase contract, according to which the seller is responsible for the costs (only) according to the state of construction on the date of notarisation (and additionally for all cost notices received until the date of tranfer), should be in the best interests of the buyer.

Example: On the day of notarisation, a new cycle path to be created is ½ completed. In a few years, the buyer will receive a notice of costs from the municipality, according to which he (in addition to the other residents) will be claimed proportionately for the production of the cycle path construction costs. Based on the provisions in the purchase contract, he can now demand half of his costs from the seller.

Of course, the contracting parties can also agree on a different cost allocation in the purchase contract.

(36) Encumbrances to be taken over, defects of title (§ 6 (1))

Whether or which land register encumbrances are taken over by the buyer depends on the specific individual case. Typically, no encumbrances are taken over in section III of the land register, but rather in section II (e.g. rights of way that allow the owner of a property in the rear to cross the purchase property or easements, e.g. for energy supply companies, that allow them to lay supply lines). Sometimes there are entries in section II that are more than 100 years old, which are often outdated in terms of content, but cannot be deleted and must be taken over by the buyer.

Encumbrances which the buyer himself has helped to create are always to be taken over. This concerns financing liens to be created by the buyer himself for his financing bank before the transfer of ownership (which the seller enables him to do according to § 9 (1)).

With regard to any building encumbrances and easements not entered in the land register, the seller assures that it has no knowledge of such encumbrances, but does not vouch for their non-existence.

Building encumbrances („Baulasten“) are not recorded in the land register, but with the building authorities in the so-called building encumbrance register („Baulastenverzeichnis“). The notary does not inspect this. If necessary, sellers or buyers (with the seller’s power of attorney) can inspect it themselves at the competent building authority(„Bauamt“) to be determined by them before notarisation or can obtain information there by telephone. A building charge is the obligation of a property owner vis-à-vis the building authority to do, refrain from doing or tolerate certain things concerning the property.

Example: The property owner undertakes not to build on a certain area of his property close to the border so that the required minimum distances between buildings can be maintained („Abstandsflächenbaulast“).

Easements not entered in the land register are extremely rare and practically impossible to find out about. These are, among other things, so-called old-law easements, which were already created before 1900, i.e. before the creation of the land register, and were not entered in the land register. We have not yet experienced the occurrence of such easements in our notarial practice.

(45) Authorisation for buyer to encumber the property (§ 9 (1))

Does the seller participate in the mortgage deed?

In order for the buyer’s financing mortgage to be recorded in the land register, the consent of the seller as the still-owner is required. The consent is given in such a way that the seller grants the buyer in § 9 (1) the (encumbrance) power of attorney to notarise such mortgages also in the seller’s name. This notarisation (“creation of a land charge/mortgage”) takes place after the notarisation of the purchase contract (ideally immediately afterwards or a few days later). An appearance of the seller at this notarisation is not necessary (and not usual) due to the encumbrance power granted to the buyer. Rather, the buyer notarises the land charge/mortgage alone, in his own name and also in the name of and with the power of attorney of the seller.

How does the so-called security agreement protect the seller?

The so-called security agreement (in italics in § 9 (1) – „Sicherungsabrede“) protects the seller from risks that might otherwise be associated with enabling the registration of buyer banks (in the security agreement the banks are called “lien creditors”) in “his” land register before he has received the purchase price. “Translated”, this security agreement mainly states that the buyer bank is obliged to have the lien (landcharge/mortgage) extinguished again if the seller withdraws from the purchase contract (e.g. due to non-payment of the purchase price) or if the contract is not executed for other reasons. It also states that the buyer’s bank may not “realise” the security right over real property before the purchase price has been credited in full, i.e. it may not call for a compulsory auction.

The buyer’s bank therefore only gains “access” to the property – despite entry in the land register – after the purchase price has been received in full. Then there is no longer any need for protection of the seller. This security agreement is also included in the mortgage/land charge deed and reliably brought to the attention of the buyer bank by the notary.

When does the buyer’s financing bank pay out the loan?

After notarisation of the mortgage, the processing times of the land registry (usually approx. 2-4 weeks) must be waited for until it is actually entered in the land registry and the bank is thus ready to pay out. The buyer should therefore independently ensure that his bank sends the so-called land charge documents (bank specific model formular) to the notary in good time before the expected purchase price due date and that a notarisation appointment takes place. If the land charge is not notarised in time, the buyer can instruct the notary (for a fee) to prepare a so-called notary confirmation („Notarbestätigung“) for his bank (this makes waiting for the entry in the land register unnecessary and can already be issued by the notary approx. 3 days after the land charge has been notarised).

(47) When does the buyer receive which invoices from whom? (§ 10)

The notary usually sends the buyer his invoice for the purchase contract a few days after the notarisation date with a 2-week payment period (at the same time as sending a copy of the notarised purchase contract). After the notarisation of a financing lien (land charge/mortgage) by the purchaser, the notary also invoices the fees incurred for this a few days later. Invoices issued by the notary are enforceable documents that allow for compulsory enforcement of the claim for payment even without a court judgment.

The land registry („Grundbuchamt“) sends separate invoices to the buyer for each entry and deletion in the land register (entry of priority notice, transfer of ownership, deletion of priority notice) with a time delay, usually no earlier than four weeks after the date of notarisation. For the issuance of so-called negative certificates – „Negativzeugnisse“ – (cf. In-depth-knowledge to explanation [20]), the competent public authority usually sends invoices to the buyer at the earliest 4 weeks after the date of notarisation. In the case of sale of condominiums, there is no invoice for a negative certificate, but the property administrator usually charges the purchaser a processing fee for the execution of the administrator’s consent to the sale (if legally required).

The tax office („Finanzamt, Grunderwerbssteuerstelle“) usually sends the buyer the real estate transfer tax notice 2-10 weeks after the purchase contract becomes effective, with a 1-month payment deadline.

If the buyer has commissioned an estate agent, his invoice will usually be sent to the buyer (and, if applicable, also to the seller) immediately after the purchase contract has become effective. According to the law (§ 652 BGB), commission claims of brokers become due for payment with the effectiveness of the purchase contract (i.e. not only with the due date of the purchase price), unless the buyer has agreed otherwise with the broker.

What are the costs at the notary, land registry, public authorities and tax office (land transfer tax)?

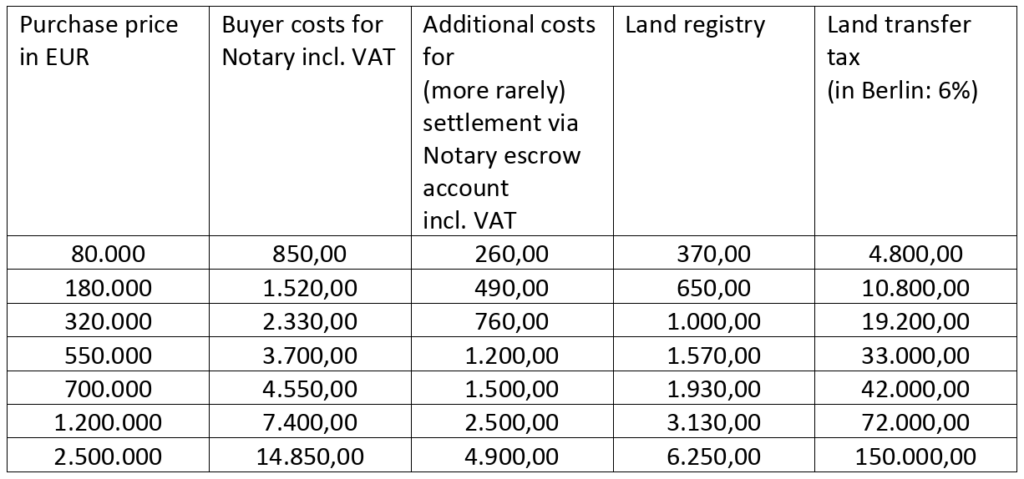

The amount of the costs of the land registry (for new entries and deletions in the land register, which take place in the context of the execution of a purchase contract) and of the notary are uniformly fixed by law throughout Germany and are not negotiable. There are no “cheap” or “expensive” notaries. The amount of land transfer tax depends on the federal state in which the property is located (e.g. Berlin 6.0 % of the purchase price, Brandenburg 6.5 %). The higher the purchase price, the lower the costs for the land registry and notary in percentage terms. Depending on the purchase price, the costs of the notary and the land registry together (very rough rule of thumb) are in the range of approx. 0.9-1.4 % of the purchase price (without the creation of a land charge and without processing via a notary’s escrow account).

The following table gives you a rough overview (the information is not binding for your specific purchase contract) of the costs that rise in line with the higher amount of the purchase price; all figures are in euros:

The above figures are not binding, but may be significantly higher or lower in your specific case, especially since the amount of the notary fees does not depend exclusively on the purchase price amount, but also on other parameters. The legal calculation of costs is quite complicated. For reasons of clarity, the table provides a rough guide using approximate sums. However, you are welcome to have the costs incurred in your case calculated by us.

If the buyer (partially) finances the purchase price and the financing bank is required to create a mortgage/ land charge, this will incur additional costs (not included in the table) for both the notary and the land registry, which together are in the range of approx. 0.5-0.8% of the nominal land charge amount (very rough rule of thumb).

The fees of public authorities for the granting of the so-called negative certificate to be obtained in the context of the sales contract amounts to usually approx. € 100.00. (Only the negative certificate, which is always to be obtained according to the building code (BauGB), is liable to pay costs, the further negative certificates are not). The processing fee of the administrator to be borne by the buyer for the completion of his disposal consent (if necessary) in the sale of condominiums is usually between 50 and 200 €.

Brokers regularly demand the customary local brokerage fee (regionally different, Berlin/Brandenburg: 7.14 % of the purchase price incl. VAT), but this is not subject to the notary’s examination, but only to the parties’ agreements with the broker. In many cases, the broker’s fee must be paid by the seller and the buyer in equal parts by law(for example, in the case of the purchase of a single-family house/apartment by a non-commercial buyer).

(52) Massive renovation work carried out less than 5 years ago or new construction (§ 11)

Such “new construction” also includes core refurbishments (e.g. first-time attic conversion) or such comprehensive refurbishments which, due to the large number or type of services, come close to a core refurbishment in terms of their character (assessment in the individual case after concrete knowledge of all services performed is required). Not included are mere renovation services below this threshold, such as are usually carried out after a tenant has moved out (painting, laying parquet flooring, new fitted kitchen, repairs to windows and doors, renovation of electrical wiring, new bathroom, etc.).

If such a “new building” exists:

- a building description, if necessary together with plans, must be included in the purchase contract. If such a description is not available, the seller or the seller’s architect will usually have to provide at least a simplified rough description of the building. Otherwise, the purchase contract could be invalid for lack of sufficient definiteness.

- the exclusion of warranty for defects contained in standard notarial purchase contracts (§ 6 (2)) is ineffective (even in the case of a sale among private persons) with the consequence that the seller is fully liable to the buyer in relation to the entire property (i.e. also in relation to the areas unaffected by renovation services). The seller is then liable to the buyer according to the statutory rules of the law on contracts for work and services (§§ 633ff. BGB) as if he had just built the property himself for the buyer as a contractor (“construction company”) on the basis of a building contract, so the seller would have to make improvements in case of defects or pay damages in case of defects. The liability period is 5 years, starting from the time when the buyer accepts the work performances vis-à-vis the seller as essentially completed („Abnahme“). The 5-year liability period also starts anew if the seller himself had already accepted the construction from his construction company, for example, 2 years ago.

The seller’s liability situation is not improved by assigning his own claims against his work contractors/construction companies to the buyer; he would then nevertheless continue to be personally liable to the buyer for 5 years with his own assets for freedom from defects.

Is it possible for the seller to exclude liability?

If this far-reaching liability of the seller is to be avoided, this requires, according to case law, a special individual exclusion of liability agreement tailored to the individual case (individual agreement) under special, detailed instructions of the buyer by the notary about the far-reaching consequences of such a waiver of liability. Only in addition to this, the seller’s claims against his work contractors (construction companies) are then regularly assigned to the buyer in the purchase contract.

The seller is strongly advised to provide the buyer with all documents relating to the construction in good time prior to the notarisation of the purchase contract, even if this may involve several folders (construction contracts, plans, acceptance reports, any requests for subsequent improvements, etc.). The buyer, in turn, should check these documents thoroughly, also in order to be able to check the “recoverability” of the claims assigned to him.

In consumer contracts (cf. In-depth knowldege on explanation [6]), in which the seller is a company (or another entrepreneur within the meaning of § 14 BGB), the seller’s liability for new buildings cannot be effectively excluded at all.

(57) Model private letter amendment agreement

Amendment agreement

We amend the purchase contract dated ……… (UVZ-Nr. …. / … of the notary ….., Berlin) as follows:

Contrary to the previous regulations in § 5 number (1) sentence 1, we agree that the transfer date already occurs on ………….., but not before the purchase price is credited.

All other contents of the purchase contract remain unchanged.

(Place, date) ……………………….., signatures of all parties

(60) How is condominium ownership created? What is the meaning of the terms “declaration of apportionment” („Teilungserklärung“), “community regulations” („Gemeinschaftsordnung“), “partition/division plans” („Aufteilungspläne“) and “certificate of separation” („Abgeschlossenheitsbescheinigung“)? (Part II. § 1)

A condominium has been legally created and can be sold as soon as a separate condominium land register folio has been created for it by the land registry. But how does it get there? (highly simplified explanation)

First of all, there is always only one land register folio (one folio number) for the entire plot of land together with the standing apartment building and all flats together. The law states that flats located in an apartment building are not in themselves individually alienable/transferable, but only the entire property together with the entire building and all the flats therein (§ 93 BGB) jointly. The individual flats are not legally independently alienable properties, they are not “marketable” because there are no separate land register folios for them. Such apartment buildings are also referred to as “undivided” houses.

Deviating from this, the Condominium Act (Wohnungseigentumsgesetz, WEG) allows for the “division” into individually saleable, marketable flats (condominium ownership) by creating a separate condominium land register folio for each flat at the land registry.

In order to achieve this, the property owner must first have the building authority certify that all flats in the apartment building are “self-contained” – „abgeschlossen“ (so-called certificate of separation, „Abgeschlossenheitsbescheinigung“), i.e. structurally separated from the other flats (by ceilings, walls, lockable door, etc.) and that household management is possible in them due to the presence of bathrooms, toilets, etc. This certificate is then accompanied by architect’s plans stamped by the building authorities which contain, among other things, the floor plans of all the flats in the house as well as views of the building (so-called partition plans or division plans – „Aufteilungspläne“). In these partition plans, one can recognise the individual different condominiums by the fact that all rooms belonging to it are marked with the same circled number, e.g. all rooms of condominium no. 1 are marked with a circled number “1”, all rooms of condominium no. 2 are marked with a circled number “2”, and so on.

With this certificate of separation and the partition plans, the property owner then goes to the notary and notarises a so-called declaration of apportionment („Teilungserklärung“). The so-called “separating owner“ („teilender Eigentümer“) stipulates that the property and the apartment building are to be legally “separated” into flats that can be sold individually and that the land registry is to create a separate flat land register folio for each individual flat. He refers to the partition plans, because they show which rooms belong to which flats. In the declaration of apportionmenthe also specifies by means of a so-called co-ownership list/partition list („Aufteilungsliste“/“Miteigentumsliste“) with which flat in each case how many co-ownership shares in the so-called common property („Gemeinschaftseigentum“) are to be connected. This concerns common areas such as the plot of land, staircase, central heating, façade, etc. As a rule, the size of the co-ownership shares is based on the ratio of the flat sizes to each other. Deviating arrangements are possible, but rare.